Portfolio Management

We provide risk analysis on portfolios, evaluate them under prevailing macro-micro economic conditions.

Review the impact of policy changes and capital market data to ensure that the portfolio is meeting

it’s goals. With command over an array of investment class products we are able to

perform extensive due diligence to help navigate through some of the most volatile times.

Investment Advisory

We understand the art and science of Asset Allocation, correlation between various asset

classes and their impact. We provide risk-adjusted investment advice with regards

to functionality, tax-treatment and expense. We will also guide you on how to

establish your attitude to investment risk and capacity for

loss through the use of discussion and scientific industry tools.

Family Office

We handle a family’s financial affairs in entirety with a deep understanding,

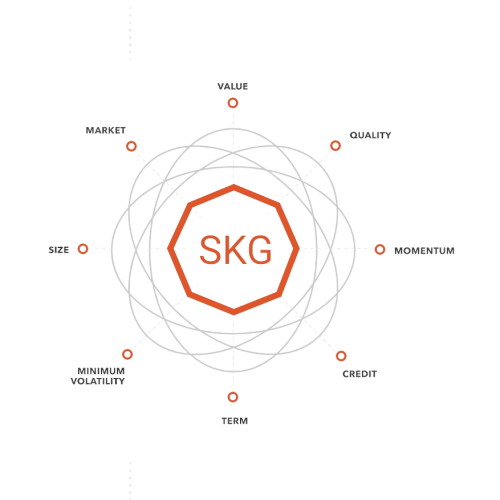

that each family office is different and has unique needs. SKG Engages in Investment strategy design,

Legal Framework Guidance, Governance Setup, Investment Guidance and Comprehensive oversight.

PE & VC Investments

At SKG we are prudent in our selection of Private Equity and Venture Capital Funds where

we feel our client’s money is safe and would generate exponential returns.

We are well aware of the dynamic nature of this asset class and the exit challenges

that investors can face; hence we tread cautiously but at the

same time ensuring that investors don’t miss a good opportunity.